In our Q2 2016 Modern Homebuyer Survey, we saw confidence uptick among Millennials who have benefitted from recent positive job and household income reports. However, with rising home prices and low inventory in much of the nation this past summer, will Millennial first-time buyers’ confidence continue its positive direction? Stay tuned for our September survey results, to be released on Wednesday October 12th. You will also learn about...

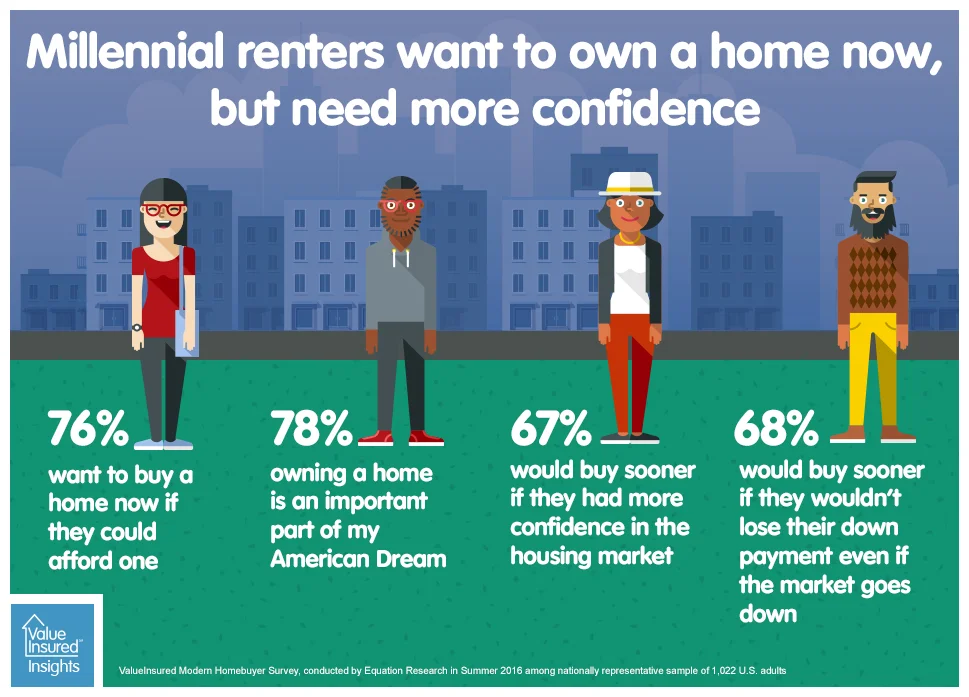

Millennial renters want to own home now, but need more confidence

It was a cultural myth that had traction for a while: Millennials are cynical, commitment-phobic “kidults” who reject the grown-up responsibility of homeownership and the American Dream. But recently, that myth has lost steam in the media. According to ValueInsured’s Modern Homebuyer Survey, which is conducted quarterly, many Millennial renters are eager to become homeowners.

In its most recent June survey, ValueInsured found most Millennial renters want to buy a home, but are held back...

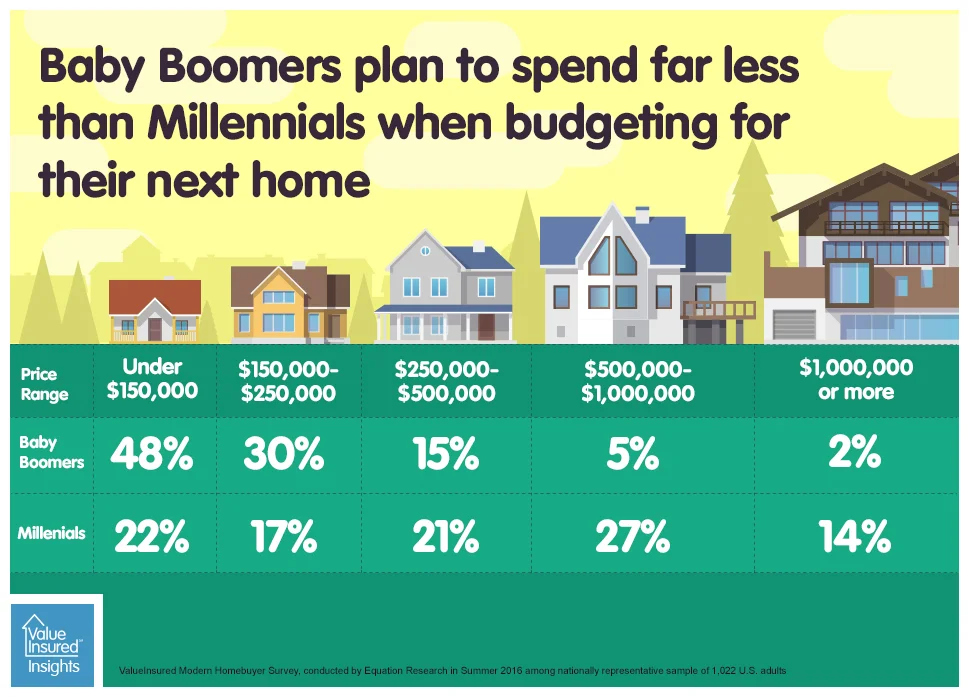

Baby Boomers – not Millennials – are key buyers of lower-priced homes

According to conventional wisdom, lower-priced homes in a market tend to appeal most to starter homebuyers, many of them are in early adulthood or what we affectionately call “ Millennials”. However, the latest ValueInsured Modern Homebuyer Survey found Baby Boomers – not Millennials – are more likely to target lower-priced homes for their next purchase.

Based on ValueInsured’s latest data obtained from 1,022 nationally representative U.S. adults in June 2016, generational breakdowns for planned home purchase prices show an interesting trend...

Millennials’ housing confidence trends up; concern for debt down

Amid a series of positive job and consumer confidence report, Millennials’ housing confidence appears to be on the rise. In the past quarter, the Bureau of Labor Statistics, the Conference Board’s Consumer Confidence Index, and report on college graduate job market have given good news to Millennials.

Since the beginning of the housing crisis, it has been a decade of doom and gloom for Millennials. According the ValueInsured Modern Homebuyer Survey, the much-needed confidence upswing for Millennials appears to be been set in motion.

Not yet in their forever home, Millennial homeowners are ripe for upgrading

Unlike their parents or grandparents, Millennials do not plan to live in the same house for 40 years.

One reason is likely due to a change in personal ideals and mindset. According to the latest ValueInsured Modern Homebuyer Survey, while “owning my own home” remains – just like for their parents – the top personal definition of the American Dream for Millennials, two other popular answers are “having the freedom to pursue opportunities wherever they are” and “being able to move and live wherever I want”.

A second – and related – factor is the reality of the modern job market. According to the latest U.S. Census Bureau data, the average job tenure of a Millennial is 3.0 years, and more than 1 in 5 Millennials moved in 2015.

A third reason ...

Millennials and other next-generation homebuyers plan to live in multi-generational households

It is often said that the American demographics are rapidly changing, and with that come the shifting demands for homes. According to the latest ValueInsured Modern Homebuyer Survey, a disproportionate number of next-generation modern homebuyers are planning to buy homes for a non-traditional, non-nuclear family household.

Housing Confidence Trending Upwards Despite Anxious New Normal

Housing a Safe Bet – But Could be Safer – in Uncertain World, Suggests ValueInsured Modern Homebuyer Survey

DALLAS, July 26, 2016 – Amid uncertainties around the global economy, national security and the national presidential campaign, Americans’ confidence in the housing market remains sturdy and, in fact, is on the rise, according to the latest ValueInsured Modern Homebuyer Survey.

The ValueInsured Housing Confidence Index was 68.7 points in June, up slightly from 67 points in March. This 1.7-point rise in confidence is consistent with improvements in the government’s June jobs report.

American renters – including Millennials – want to own homes, but face tough barriers

It has been well reported that Millennials are commitment phobic – to jobs, to relationships, and to homeownership. Conventional thinking says even financially viable Millennials are often renters by choice because they share a different American Dream than the previous generations and they don’t want the hassle and responsibility of owning a home. But ValueInsured believes their attitudes deserve a second look.